Chưa phân loại

cfd trading platform

Cfd trading platform

Contract for Difference (CFD) trading is a financial derivative that allows traders to speculate on the price movements of various financial instruments without actually owning the underlying assets Versus Trade. CFDs are popular in financial markets, including stocks, indices, commodities, currencies, and cryptocurrencies. This article will help you understand CFD trading better.

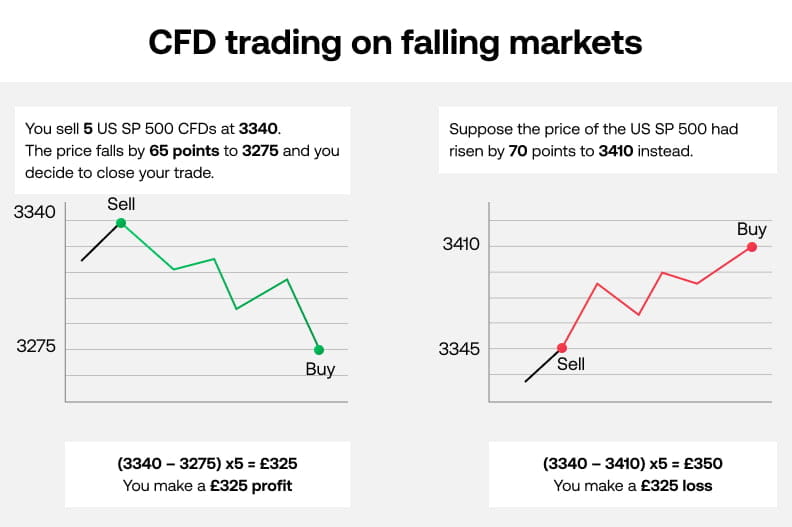

CFD trading allows traders to be market agnostic. In traditional investments, one can only profit when the asset’s value increases. However, in CFD trading, going short enables traders to profit from market declines as well.

Demo Trading: Before risking real money, practice your strategies in a demo account. This allows you to familiarize yourself with the trading platform and refine your approach without financial risk. There’s a tip – treat the demo account as seriously as a live account to simulate real market conditions.

The ability to go long or short provides traders with a diverse set of strategies. In addition to benefiting from market uptrends, traders can also employ strategies that take advantage of downtrends or market corrections.

Cfd trading platform

With that said, there is often a vast disparity in what assets you will have access to at your chosen CFD trading platform. For example, eToro covers everything from stocks, ETFs, indices, cryptocurrencies, forex, and commodities.

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

If you already have experience with traditional investments like stocks or ETFs and you want to learn how to trade from a margin account, a demo account can be a good place to start. Demo accounts allow traders to experiment and familiarize themselves with trading software without risking any investment capital. The software is largely the same, but the demo account uses virtual funds; a “live” account is one where you fund the account with real money.

-min.png)

With that said, there is often a vast disparity in what assets you will have access to at your chosen CFD trading platform. For example, eToro covers everything from stocks, ETFs, indices, cryptocurrencies, forex, and commodities.

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

Cfd trading malaysia

When swing trading, it’s important that you identify support and resistance levels for an asset of interest using a variety of technical indicators. Most swing trades occur over a few days to several weeks, or as long as strong price momentum lasts.

XTB, which is an acronym for X-Trade Brokers, is one of the most popular CFD brokers in the world having its headquarters in Warsaw, Poland. It was incepted in 2002 by Jakub Zablocki. The company has its own trading platform, xStation 5, which is very intuitive, and comes with numerous analytical instruments.

Creating my position is a two-stage process involving take profit and stop loss orders. These tools help me to manage risk, by automatically closing my trade if the CFD price rises or falls to a level I select, whichever comes first.

But when you trade CFDs, you don’t actually own the underlying asset at any point. So instead of owning the underlying asset like when you buy Bitcoin or buy stocks, you’re simply speculating on the price. Much of the forex trading that takes place online is also done via CFDs in order to avoid conversion costs. CFDs remove much of the logistical and legal hassles that can be associated with owning foreign currencies or cryptocurrencies outright brings logistical and legal hassles that don’t exist with CFDs.