Chưa phân loại

Blockchain What is staking as well as how it truly does work?

“A passive or amateur representative can just stake their cryptos directly on the fresh exchange for a bit a lot more convenience, in exchange for the fresh change getting part of the staking productivity,” says Trakulhoon. To find Solana (SOL) in australia is a straightforward process, obtainable because of various cryptocurrency exchanges. First off, you’ll need to manage an account for the a reliable replace you to definitely lists SOL, including Binance, Coinbase, otherwise Kraken. Once your fund is actually transferred, demand SOL/AUD field to your change, where you are able to set an order to purchase SOL from the sometimes the current market value otherwise a selected limitation speed.

Bhat says it’s advisable that you come across a reliable pool, you may not should find the natural biggest. Blockchains are meant to end up being decentralized, generally there’s a quarrel to possess stopping anybody class out of racking up as well much determine. Crypto staking is an essential part of your technical at the rear of certain cryptocurrencies. Although not, it is important to note that not all crypto systems explore staking.

Their advised reduces is next appended for the ledger if the considered legitimate by the many consensus out of almost every other validators/miners and you may full nodes. In this article, we’ll talk about the basics of staking cryptocurrency, how it operates, and just why it is commonly used inside the blockchains and you will DeFi ecosystems. I in addition to take a look at just how oracle network staking character compare to and you can differ from staking within the established implementations within this blockchain sites. To understand staking, it’s necessary to learn opinion components, the various tools blockchains used to make certain purchases plus the security from the brand new blockchain.

People can usually still accessibility the guess coins but could simply have the ability to use them for most other intentions when they try no longer bet. Staking ‘s the securing right up out of cryptocurrency tokens since the equity to assist safe a system otherwise smart deal, or perhaps to get to a particular effects. Past, staking, like most cryptocurrency funding, deal a premier danger of losings.

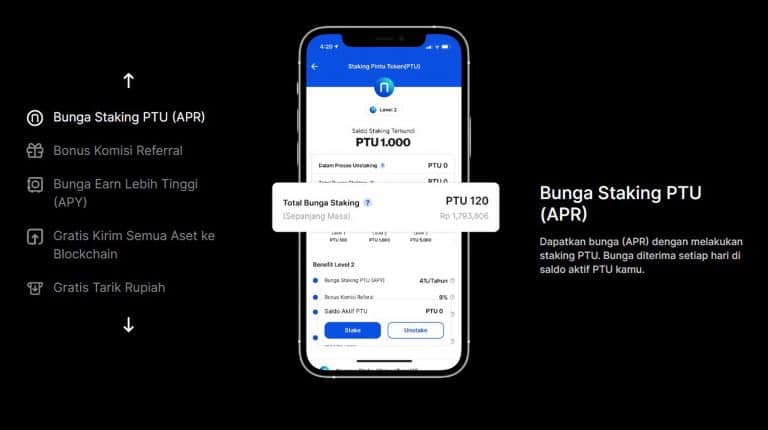

Staking are a way of setting tokens inside the a specific lock upwards, so you can discovered a financial go back, which often results in finding more of the same token, or perhaps in Blockchain Bets instance, BCB, ETH and you can USDT. Staking removes tokens on the most recent circulating likewise have and so the far more tokens that will be locked-up the better, because produces buy stress to the Centralised and you can Decentralised Exchanges whenever people want to invest. For this reason, securing tokens up-over a particular months thus buyers don’t sell, needs fairly significant economic incentive. Over the past week or so, there were a surge inside Blockchain Bets (BCB) token holders and you will stakers inside platform, that have arrived at ask a range of questions relating to the newest staking plan and you will spend-outs.

On the blockchain tech, grasping the idea of what’s hash is essential. The new Hashing definition goes beyond only techniques; they variations the fresh core from exactly how blockchain setting. For this reason, you ought to take time to educate yourself on staking just before paying.

Jupiter swap – + What exactly is staking?

In contrast, the brand new bearish perspective raises very important questions relating to the fresh sustainability of the structural choices and you can untested frontrunners in the face of possible challenges. “Quantities inside decentralised exchanges (DEX), NFT change, and you may stablecoins for the Solana have started so you can competition or have overtaken the individuals for the Ethereum,” states Bronze. The affect solution makes it simple so you can deploy basket-based GPU instances inside mere seconds, away from both societal otherwise personal repositories.

Crypto transfers such Coinbase, Binance and you will Kraken give staking while the a component to their systems. According to the blockchain, crypto citizens can also be earn production of 5percent to 14percent to your their holdings because of the staking. Decentralization is at jupiter swap the center from blockchain tech and cryptocurrency. There’s no central gatekeeper to manage a good blockchain’s checklist away from transactions and investigation. Alternatively, the newest network utilizes an armed forces from participants to validate arriving deals and you can create him or her as the the newest prevents to your chain.

To have buyers, staking is a great possible opportunity to play with their cryptocurrencies generate a lot more income. It’s an enticing offer that enables these to earn significant money when you are retaining ownership of its crypto assets. Simultaneously, it stays separate out of a prospective increase in the cost of a coin or token.

How does Staking Operate in Crypto?

The very first blockchains was safeguarded because of the a procedure titled evidence away from performs, otherwise PoW. Crypto miners fixed analytical troubles to add reduces to your blockchain and maintain they safer and secure. Staking brings crypto people (stakers) a method to secure perks by securing right up a fraction of its cryptocurrency, said Vikas Agarwal, monetary crimes tool commander from the PwC. Staking enables crypto proprietors to make perks when it comes to attention, or maybe more crypto, without the need to promote/trading its cryptocurrency.

By allowing the new network so you can techniques rollups more easily, danksharding will assist Ethereum avoid obstruction. This will improve energy fees for the wide Ethereum system—not merely having fun with a layer a couple of strings. Imagine cryptocurrency staking is done with coins that have few deals in the the marketplace. In that case, the risk will be extremely high, and you will changing income to your real money and other cryptocurrencies might be a challenge.

Whenever choosing a great staking blockchain to participate in, it’s vital that you imagine token dilution, or perhaps the rising prices of your own token. Dilution is the losing worth of a single cryptocurrency and/or business capitalization of a great cryptocurrency process considering the minting of the latest tokens. The more tokens is actually minted, the brand new shorter existing tokens are worth, barring some other additional issues.

Step three: Install the program purse to your wished money

While the premier wise bargain blockchain, Ethereum features confronted high demands within the scaling the infrastructure to meet the new growing demand. But not, ongoing scaling work including sharding and also the Ethereum Dencun modify represent encouraging steps to the raising the network’s capacity and gratification. To learn their importance in the crypto even when, it’s important to remember that Ethereum currently locations each of the investigation on every node from the network—and that investigation persists permanently. It can so it having its chronic memories store, calldata, although not, this method out of storing information is hefty for the program, also it’s really expensive. Even after such professionals, staking also offers cons you to definitely traders should be aware of, such as industry, exchangeability, contraction, and you may shelter threats.

Trading in the contracts to own difference (CFDs) are riskier than conventional express exchange, maybe not suitable for most people, and you will boasts the chance of partial otherwise full death of funding. You should always imagine if you can afford to get rid of the currency before carefully deciding in order to trade-in CFDs or cryptocurrency, and you may consult an enthusiastic authorised financial mentor. Rather than PoW exploration, staking demands a direct funding from the crypto becoming wager. Validators is actually incentivized to sign up to the newest system security since the incapacity to accomplish this may result in the increasing loss of the whole money. You could potentially participate in staking certain gold coins that with an associated crypto purse. Staking is available in PoS coins, including Ethereum,Polkadot, Tezos, Polycon, Binance, Solana and you will Avalanche.

Certain crypto exchanges also offer staking software in which it manage the new tech info to own a cut fully out of the proceeds. PoW—a system nevertheless utilized by Bitcoin and other blockchain sites—demands fixing really complex statistical difficulties before any information will likely be put into the brand new blockchain. Follow the circle-specific guidelines for staking, which may include assigning coins to help you a great validator node otherwise running a good validator node on your own. This short article can be found to your chosen blockchain’s authoritative website. Users generally need to immobilize its coins for a fixed several months whenever staking its crypto. Quick access these types of coins may be minimal during this period, preventing them out of selling their holdings as quickly as they generally create once they weren’t bet.

If the miners don’t secure money thru exploration advantages, then the money expense on the devices and power use will come at the a loss of profits. If your security of your own circle is not kept, then your value of the device useful for mining and the assets from exploration is decrease in market price, undertaking a keen implicit financial penalty. That have proof of risk, professionals described as “validators” lock-up lay levels of cryptocurrency or crypto tokens—their share, because were—inside a smart deal to the blockchain. Reciprocally, it rating the opportunity to examine the newest deals and you may earn a great award. But if they badly examine bad otherwise deceptive study, they may remove particular otherwise all their share because the an excellent penalty.

Do you know the Benefits of Staking Crypto

Since the coins already have “baked inside the” research from the blockchain, they’re used while the validators. Up coming, to possess enabling those holdings to be used since the validators, the fresh network perks the new staker. Blockchains is actually “decentralized,” definition truth be told there’s zero middleman — including a financial — to confirm the new activity and make sure they comports which have a great historic checklist managed by the hosts along side network. As an alternative, profiles collate “blocks” of recent purchases and you may complete her or him to possess introduction for the an enthusiastic immutable historical list. Pages whose blocks is actually approved get a purchase fee paid-in cryptocurrency.

The technique of staking is increasingly popular because the networks for example Ethereum build staking accessible when you’re far more blockchains adopt evidence-of-risk consensus mechanisms. Learning about cryptocurrency staking is a superb foundation of mastering which possibly lucrative strategy. Under this program, community professionals who would like to support the blockchain from the verifying the brand new deals and incorporating the brand new stops have to “stake” place figures away from cryptocurrency. Their enhanced connections to a staking system or blockchain circle are why are cryptocurrency staking high-risk—far more risky than simply carrying your own tokens inside a secure digital purse. Basically, blockchains provide you to service (i.age. confirm reduces) one to pursue a collectively agreed upon and predefined group of legislation.

This course of action demands none official equipment nor a lot more measuring electricity. There are several standards available to choose from that provide drinking water staking choices, and it is crucial that you do your homework about them just before getting the difficult-made ETH to the one to. Those individuals able and ready to risk a full node (32 ETH) is unicamente stake by running a good validator themselves home, otherwise fool around with thinking-custodial staking possibilities including Consensys Staking. Along with 565,100 validators staking the high quality 32 ETH for each—more than 32 billion in the today’s costs—Ethereum’s Evidence of Risk (PoS) device is the most significant example of staking within the web3.

“So it move does not only boost perks to the stakers, and also target the environmental issues associated with mining,” the guy said. When you’ve purchased staking crypto, you will receive the assured return according to the schedule. The application form will pay the come back regarding the bet cryptocurrency, that you’ll up coming keep as the an investment, install for staking, or change for the money or any other cryptocurrencies. “For each and every blockchain system usually has 1 to 2 authoritative wallet apps you to help staking. Including, Avalanche gets the Avalanche wallet, and you may Cardano has Daedalus and you can Yoroi purses,” Trakulhoon points out.

History of Staking

Which have lower opportunity needs and you can an advanced level out of usage of for everyday people to join while the validators, evidence of risk has many glamorous has that could take it to your mainstream to own blockchain shelter. Moving a great cryptocurrency out of proof try to proof of share is a complicated and you will very intentional process. One crypto you to wants to changes opinion components will have to go through a challenging considered way to ensure the blockchain’s integrity always and you can beyond. Staking comes to locking up a certain number of cryptocurrency inside a appointed purse otherwise platform. It secured cryptocurrency is then used because the guarantee to help with community operations and earn rewards in the way of additional cryptocurrency tokens.

There are even non-staking choices for making on your own crypto, along with credit software and you may decentralized financing (DeFi) software. The official websites of several evidence-of-risk blockchains are information on how to analyze validators, and hyperlinks to factual statements about the way they operate. Eventually, it is really worth remembering you to definitely third-party crypto staking software usually require you to keep the crypto online, on their systems. That can make you susceptible to prospective losings even if from a good crypto change failure including the FTX failure. Validators are responsible for verifying and you can batching transactions to your reduces. They browse the performs out of most other validators, which will keep the brand new blockchain accurate and you will productive.

While you are rollups provides security measures to protect from this, they’re not while the sturdy since the Ethereum mainnet. As well as, because the an alternative type of purchase, there’s a new payment device to complement. Based on EIP-1559, the fresh rates framework to have blob-holding purchases are active; based on also provide and you may demand. Normally, more about three blobs for each purchase trigger higher charge, differing by the as much as a dozen.5percent from cut off in order to stop.

The level of benefits you have made depends on simply how much you risk and also the token’s specific staking system. Of a lot imagine Ethereum’s advantages at around 5–6percent at the time of a few days through to the Merge. Both most common consensus components used by cryptocurrencies is proof-of-works (PoW) and proof-of-share (PoS).

It needs suitable calculating gizmos and software and you may getting a good backup out of a good blockchain’s entire purchase history. Specific information that is in public offered makes it possible to see whether a share driver features ever before become penalized to have problems or malfeasance, and several put down the principles to own securing individuals who outsource tokens. Most other details you can test include the quantity of charges or income. To accomplish this, you’ll have probably to understand strategies for a crypto purse to get in touch your tokens to the validator’s pond. Pages suggesting another cut off — or voting to simply accept a proposed take off — set a few of their cryptocurrency at stake, which incentivizes playing by the laws.

For many who very own an excellent cryptocurrency using an evidence of stake blockchain, you’re permitted share the tokens. “Inside PoS, validators share their assets while the a body-in-the-online game, which will get slash otherwise destroyed when they function maliciously,” claims Gritt Trakulhoon, head crypto expert to own Titan, an investment program. For example, seeking to create a fake cut off away from purchases you to definitely didn’t happen.

Rising prices encourages users to spend their coins instead of keep them, that may enhance their explore since the a cryptocurrency. But with that it model, validators can be assess just what staking reward they are able to predict. Specific blockchain systems ensure it is users who share its crypto to have voting liberties and determine the brand new governance of your system. Thus giving stakeholders a vocals within the proposing and you will deciding on method improvements, transform, and advancements, allowing them to profile the future assistance of your own community.